As we have seen in the previous posts, not all the Electric Plazas that would be needed will be built, because in many case there is no financial sustainability, at least not at the desired cost of service level.

The best locations: the Electric Plaza Location Identifier

OneWedge started by researching where our clients are, developing a proprietary map of warehouse locations across Europe; while obviously work in progress, this map already covers over 1000 locations across several countries, with more being added every week. This is good starting point, because it allowed us to identify geographical concentrations which are prime locations for an Electric Plaza, as many potential clients are in its immediate vicinity.

But that is not enough: land is divided into separate plots, with distinct ownership, each of which may or may not have development and usage destination constraints that need to be taken into account. Additionally, the availability of power is not the same everywhere, and some locations might be preferable to others because significant electric generation assets already exist. Last but not least, we need to identify which plots are actually up for sale and compare the ask price of each.

All the information I described already exists and we are integrating them all in a proprietary country-specific GIS system that will allow for the rapid assessment of the real estate situation of any given geographical area.

Which ones to pick? The Electric Plaza Digital Twin

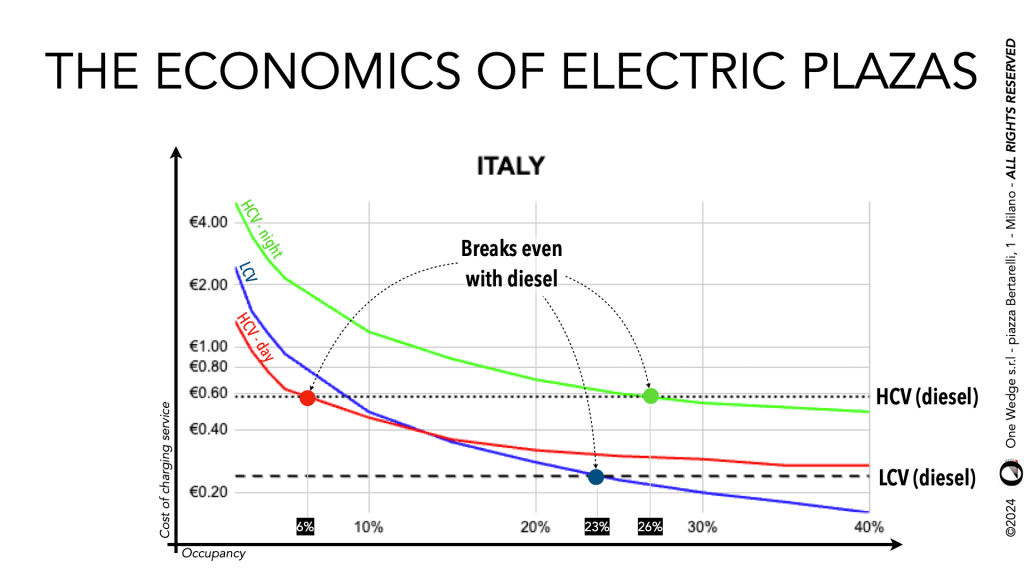

But, as we said at the beginning, this does not means that all necessary Electric Plazas will be built, because fleet operators demand a cost of fuel that is AT MOST on a par with diesel, capital needs to be rewarded (imagine if we were to take out a loan from a Bank) and the Charge Point Operator needs to obtain a profit to sustain its operations.

Where one or more of these goals is not attained, building an Electric Plaza becomes unlikely if not impossible; we therefore need a model to evaluate under which conditions a candidate Electric Plaza will meet the three goals.

OneWedge has developed such a model, which we called the Electric Plaza Digital Twin, leveraging our experience in building plants like these in the past few years. Without going into too much detail, we can say it includes different charging scenarios:

- “LCV” is an Electric Plaza where vans are charged during the night;

- “HCV – night” is similar, but charges heavy trucks, while

- “HCV – day” does the same during the day, but with much shorter stops of about 60 to 90 minutes.

Using the Electric Plaza Digital Twin, we can study how the cost of service behaves as a function of the occupancy rate of an Electric Plaza which meets the first two goals of rewarding the capital and generating an operating profit.

The important information contained in this chart is that the third goal (cost of service equal or lower to diesel) is met ONLY beyond a certain occupancy rate threshold.

These thresholds are specific for each country, the two main drivers being cost of land and of grid connections.

Conclusions

- Charging an electric fleet will require many solutions working together

- Electric Plazas complete the puzzle of those already in place (home, depot & transit) with a bespoke, capex-free, charge-as-a-service solution

- Electric Plazas have three stakeholders:

- the fleet operator (seeking a competitive charging cost),

- the investor (seeking an attractive IRR)

- the operator’s shareholders (seeking an adequate profit margin)

- As a result, Electric Plazas are NOT possible everywhere: cost of land and power availability being the main limiting factors

- Rapid scouting is paramount: failure to secure locations “within parameters” will result in electrification slowdown and/or fuel costs increase